michigan property tax rates by township

A property tax is the most. The average effective property tax rate in Macomb County is 168.

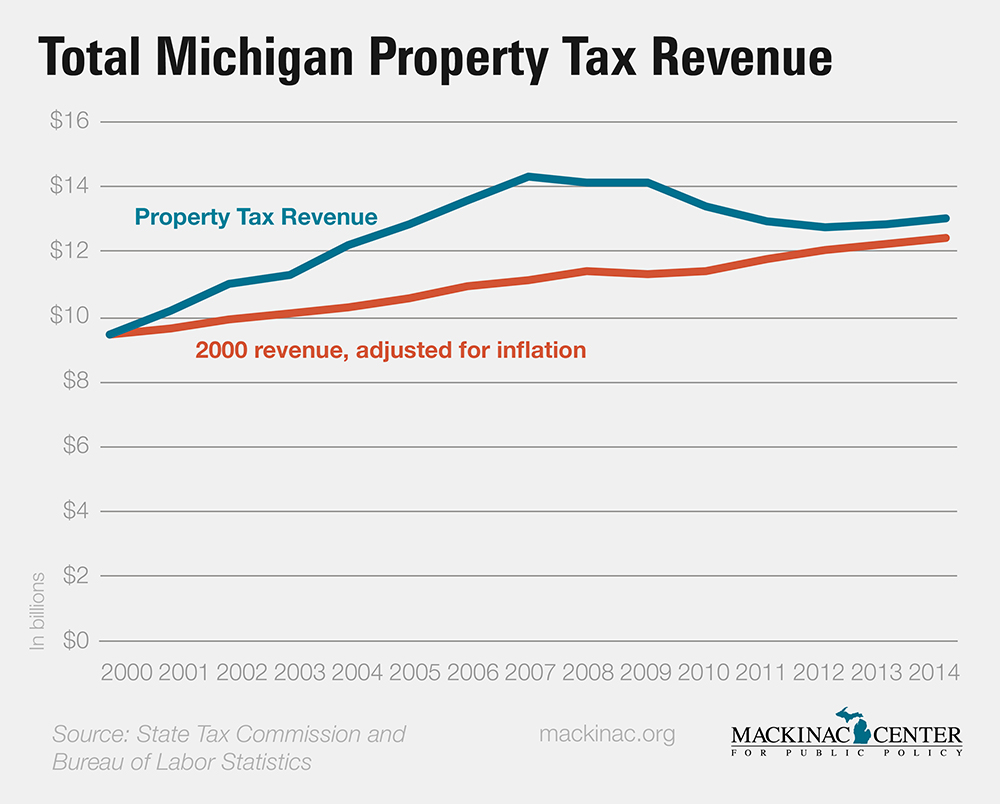

Michigan Property Tax Revenues Up Mackinac Center

For more details about the property tax.

. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. The median property tax in Macomb County Michigan is 2739 per year for a home worth the median value of 157000. Michigan will have the 13th highest property taxes in 2020 with an effective property tax rate of 144 percent according to the Tax Foundation.

Property is forfeited to county treasurer. Clarkston School District. Send your check money order to.

Macomb County collects on average 174 of a propertys. The Millage Rate database and. The Pittsfield Township 2019 Total Tax Rate of 64381 breaks down in the following way.

This can be obtained from your assessment notice or by accessing your tax and assessing records on our. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Real and personal property taxes are the combined total.

Michigan Business Tax Exempt Special Notes. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. We are open Monday through Friday from 830 am to 430 pm.

Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Interest increases from 1 per month to 15 per month back to 1st prior year.

In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313. The school district your property is located in determines the annual millage rates applied to calculate the taxes on your property. Taxes Tax Comparison Ordered by Millage Rate.

For township millage rates please visit the Township Millage page. For existing homeowners please enter the current taxable value of your property. Simply enter the SEV for future owners or the Taxable Value.

23060 Grand Ledge of Total. Pontiac School District. County Treasurer adds a 235 fee.

Beginning March 1 2023 unpaid taxes can no longer be paid at the Township offices and must be paid directly to Robert Wittenberg Oakland County Treasurer 1200 North. Counties in Michigan collect an average of 162 of a propertys assesed fair. 84 rows To find detailed property tax statistics for any county in Michigan click the countys.

Michigan Property Tax H R Block

Michigan State Taxes 2021 Income And Sales Tax Rates Bankrate

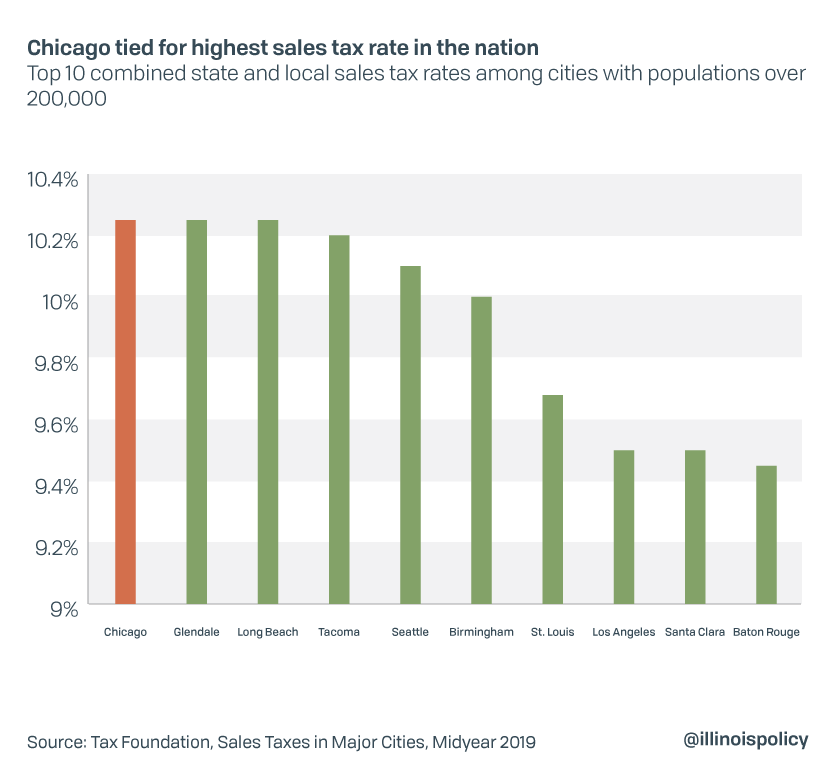

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

The Ultimate Guide To Michigan Property Tax Easyknock

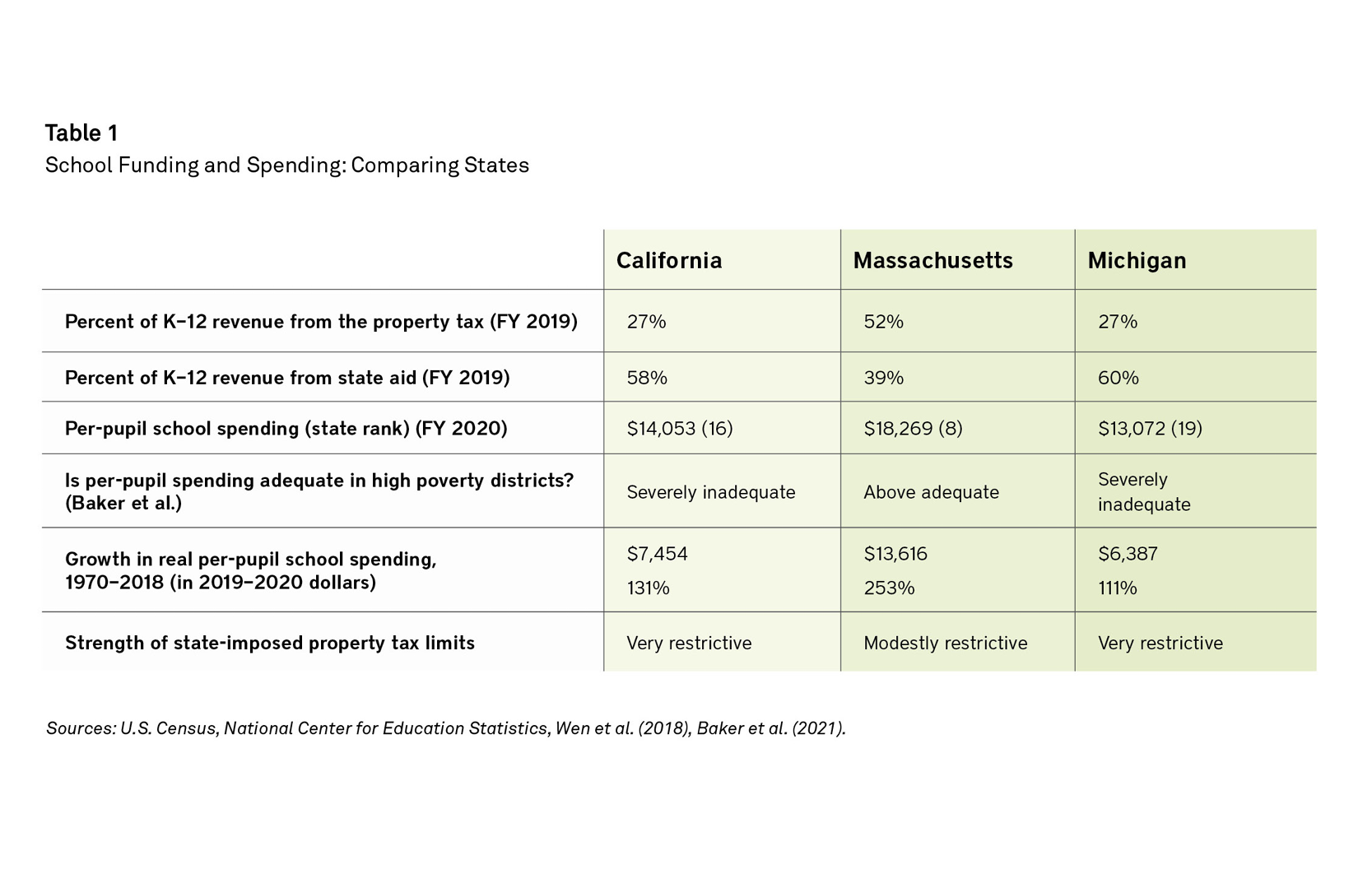

Public Schools And The Property Tax A Comparison Of Education Funding Models In Three U S States Lincoln Institute Of Land Policy

State Individual Income Tax Rates And Brackets Tax Foundation

State Individual Income Tax Rates And Brackets Tax Foundation

Where Are Property Tax Rates Highest And Lowest In Michigan Mlive Com

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan

Top 10 U S Counties With The Greatest Effective Property Tax Rates Attom

Expert Talks Dfw Homestead Exemptions Local Schools Deal With Staffing Crisis Community Impact

Assessor For Liberty Township Clarklake Michigan

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan

Natick To Set 2022 Tax Rates With Residential Values Up 7 1 Natick Ma Patch

As Michigan Real Estate Values Rebound Property Tax Revenues Continue To Lag Mlive Com

Redford Township Government Departments Assessor About The Assessing Office

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation